The difference between a product that flies off digital shelves and one that dies in obscurity isn’t features, funding, or timing—it’s the depth of market understanding you excavate before writing a single line of code. Research from Failory’s startup analysis reveals that 34% of founders cite “lack of product-market fit” as the fatal blow, yet 68% admit they spent minimal time interviewing potential customers before building. We craft detailed user personas based on imagination, then wonder why real humans don’t behave as scripted.

Consider the true cost of getting this wrong. A founder spends six months and $40,000 building a sophisticated analytics dashboard for e-commerce store owners. At launch, conversion rates hover at 0.8%. After painful customer conversations, she discovers her target users—small Shopify merchants—don’t understand analytics and want simple “more sales” recommendations, not data visualization. Another founder, wary of this trap, spends three weeks interviewing 50 store owners before building. He learns they spend hours manually creating Instagram posts from product photos. He launches a simple tool that auto-generates social content from product catalogs. First-month revenue: $12,000. The difference wasn’t technical skill; it was investigative depth.

Understanding your target market isn’t a checkbox exercise—it’s a disciplined investigation into the lives, frustrations, and decision-making algorithms of people you’re asking to change their behavior. The right questions, asked in the right sequence, reveal not just what people say they want, but what they’ll actually reach for their credit card to obtain. This is the difference between market research and market forensics.

- The Market Mirage: Why Demographics Deceive Founders

- The 7 Dimensions of Market Understanding

- Dimension 1: Pain Gravity

- Dimension 2: Current Solutions

- Dimension 3: Decision Dynamics

- Dimension 4: Price Psychology

- Dimension 5: Channel Habitat

- Dimension 6: Success Metrics

- Dimension 7: Switching Triggers

- The Art of the Customer Interview: Question Architecture

- The Competitive Intelligence Goldmine: Questions They Won’t Ask

- The Competitive X-Ray Framework

- The 21-Day Market Immersion Sprint

- The Market Immersion Calendar

- The Segmentation Trap: Why “Everyone” Is the Wrong Answer

- The “Solution Attempt” Segmentation Method

- The Empathy Gap: Why You Can’t Trust Your Own Instincts

- Building a Living Market Intelligence System

- The Market Is Already Speaking. Are You Listening?

The Market Mirage: Why Demographics Deceive Founders

Most founders define their target market by demographics: “Women 25-40, urban, college-educated, $75K+ income.” This is like navigating by looking at the sky—technically accurate but practically useless. These attributes describe who someone is, not why they buy. A 32-year-old graphic designer in Austin and a 32-year-old graphic designer in Portland might share age and income, but one values efficiency tools while the other values community features. Demographics tell you where to find them; psychographics tell you what makes them tick.

The critical failure point occurs when founders extrapolate their own psychographic profile onto their demographic target. You might be a 28-year-old developer who loves keyboard shortcuts and dark mode, so you assume all developers do. But your market might be 45-year-old developers who value one-click simplicity and phone support. Without asking, you’re building for a mirror, not a market.

Harvard Business Review research shows that psychographic segmentation is 3.5x more predictive of purchase behavior than demographic data. Yet founders persist in creating “user personas” that are essentially demographic dolls with cute names like “Marketing Mary” or “Developer Dave.” These personas feel productive but produce products that miss the mark because they describe who people are statically, not what drives them dynamically.

The breakthrough comes when you realize your target market isn’t a demographic bucket—it’s a specific moment of frustration. The busy parent who needs grocery delivery isn’t “female, 35, suburban”—she’s “someone with 17 minutes between conference call and soccer practice who needs to feed three people with conflicting dietary restrictions.” The former definition guides you to advertise on Facebook; the latter guides you to create a 5-minute meal kit solution that wins the market.

Identity Questions: “When you think about your work, what three words would you use to describe yourself?” (Reveals self-perception)

Status Questions: “What tool do you currently use that you recommend to peers?” (Reveals aspiration)

Anxiety Questions: “What’s the one thing you worry your boss/client will discover about your process?” (Reveals hidden pain)

Time Questions: “If you had an extra hour today, what would you actually do with it?” (Reveals priority hierarchy)

Community Questions: “Where do you go to complain about tools in your industry?” (Reveals influence networks)

Aspirational Questions: “What tool would make you look like a hero to your team?” (Reveals career-driven motivations)

The 7 Dimensions of Market Understanding

Comprehensive market understanding operates across seven distinct dimensions. Skipping any one leaves a blind spot that competitors will exploit. The founders who dominate markets are those who map each dimension before committing resources.

These dimensions aren’t theoretical—they’re practical investigation zones, each with its own battery of questions designed to move you from guesswork to guestwork (where you’re a guest in your customer’s mental space, observing how they actually think).

Dimension 1: Pain Gravity

Key Questions:

“Walk me through the last time this happened.”

“How often does this problem occur weekly?”

“What does it cost you when it happens?”

“Who else gets affected by this?”

Example: A founder building tools for podcasters discovered that editing wasn’t the real pain—finding guests was. The gravity was in the network, not the workflow.

Dimension 2: Current Solutions

Key Questions:

“What do you use now to solve this?”

“What do you wish it did better?”

“Why haven’t you switched to something else?”

“What workaround have you built?”

Example: Users “hated” Excel but kept using it because they could customize formulas. The competitor wasn’t another tool—it was Excel’s flexibility.

Dimension 3: Decision Dynamics

Key Questions:

“Who else weighs in on this purchase?”

“What would your boss need to see to approve this?”

“What’s the approval process like?”

“Who would veto this and why?”

Example: A tool for sales reps failed because it didn’t include reporting for sales managers. The user loved it; the buyer (manager) saw zero visibility.

Dimension 4: Price Psychology

Key Questions:

“What did you last pay for a similar tool?”

“Who controls the budget for this?”

“What would need to be true to pay 2x more?”

“What’s the most you’d pay to make this disappear?”

Example: Small business owners wouldn’t pay $99/month for bookkeeping automation but would pay $299 for “tax audit insurance.” Same product, different positioning.

Dimension 5: Channel Habitat

Key Questions:

“Where do you discover new tools?”

“Which newsletter do you actually open?”

“What podcast made you buy something?”

“Who do you follow on Twitter/LinkedIn for recommendations?”

Example: Developers found new tools on GitHub trending, not Product Hunt. Founders wasted ad spend on the wrong hunting ground.

Dimension 6: Success Metrics

Key Questions:

“How would you measure if this worked?”

“What does ‘better’ look like in 30 days?”

“Who would notice the improvement?”

“What number would prove this was worth it?”

Example: A marketing tool promised “better campaigns” but customers measured success by “fewer hours in Google Analytics.” The metric changed the entire product.

Dimension 7: Switching Triggers

Key Questions:

“What would make you switch tomorrow?”

“What’s your breaking point with current solution?”

“What event triggers tool evaluation?”

“What would have to break for you to look for alternatives?”

Example: Companies switch accounting software not because of features, but because their accountant refuses to work with their current system. The trigger was external.

The Art of the Customer Interview: Question Architecture

The difference between useless small talk and market-shifting insight is question architecture. Most founders ask leading questions that validate their assumptions: “Wouldn’t it be great if…?” or “Don’t you hate when…?” These questions manufacture false positives. The craft is in asking questions that make the customer’s real world visible to you.

Interview masters at Y Combinator’s “How to Talk to Users” emphasize that your goal is to become a student of their life, not a presenter of your solution. Every question should feel like a natural exploration, not an interrogation. The best interviews feel like therapy sessions where the customer discovers truths about their own behavior as they speak.

The architecture follows a funnel: start broad, then narrow. Begin with context (“Tell me about your role”), move to problems (“What’s most frustrating?”), explore current solutions (“How do you handle it now?”), test hypothetical value (“If you had a magic wand…”), and finally measure commitment (“Who else should I talk to?”). This progression builds trust and surfaces truth, not flattery.

The Competitive Intelligence Goldmine: Questions They Won’t Ask

While your competitors are building features based on their own roadmaps, you can win by understanding the emotional geography of the market. This requires asking questions about alternatives that most founders either don’t think to ask or are afraid to ask because they might hear that competitors are “good enough.”

The secret is to treat competitors as your free market research department. They’ve already educated customers, established pricing anchors, and revealed feature expectations. Your questions should map their weaknesses—not technical flaws, but experience gaps. When a customer says “I love Asana,” your response shouldn’t be defensive; it should be investigative: “What’s the one thing Asana makes you do manually that you wish was automatic?”

This approach reveals the “competitive moat” illusion—most moats are actually just habits and switching costs, not true product superiority. When Slack dominated team chat, competitors assumed the moat was integrations. But interviews revealed the real moat was “we’re already here.” The vulnerability was in the onboarding experience for new team members, which was confusing. A startup that made “instant team setup” their core feature siphoned off 10,000 teams in a year.

The Competitive X-Ray Framework

Ask About Their Workflow:

“When you export data from [competitor], what’s the first thing you do with it?”

Reveals: Integration gaps, manual workarounds, opportunity for automation

Ask About Their Onboarding:

“How long did it take before you felt productive using [competitor]?”

Reveals: Time-to-value friction, opportunity for instant gratification

Ask About Their Bill:

“What line item would your CFO cut first in a downturn?”

Reveals: Perceived value vs. cost, stickiness factors, pricing vulnerability

Ask About Their Team:

“Who on your team refuses to use [competitor] and why?”

Reveals: Internal adoption friction, user experience failures, expansion blockers

Each answer is a roadmap to a feature your competitor won’t build because they’re too busy optimizing their existing roadmap.

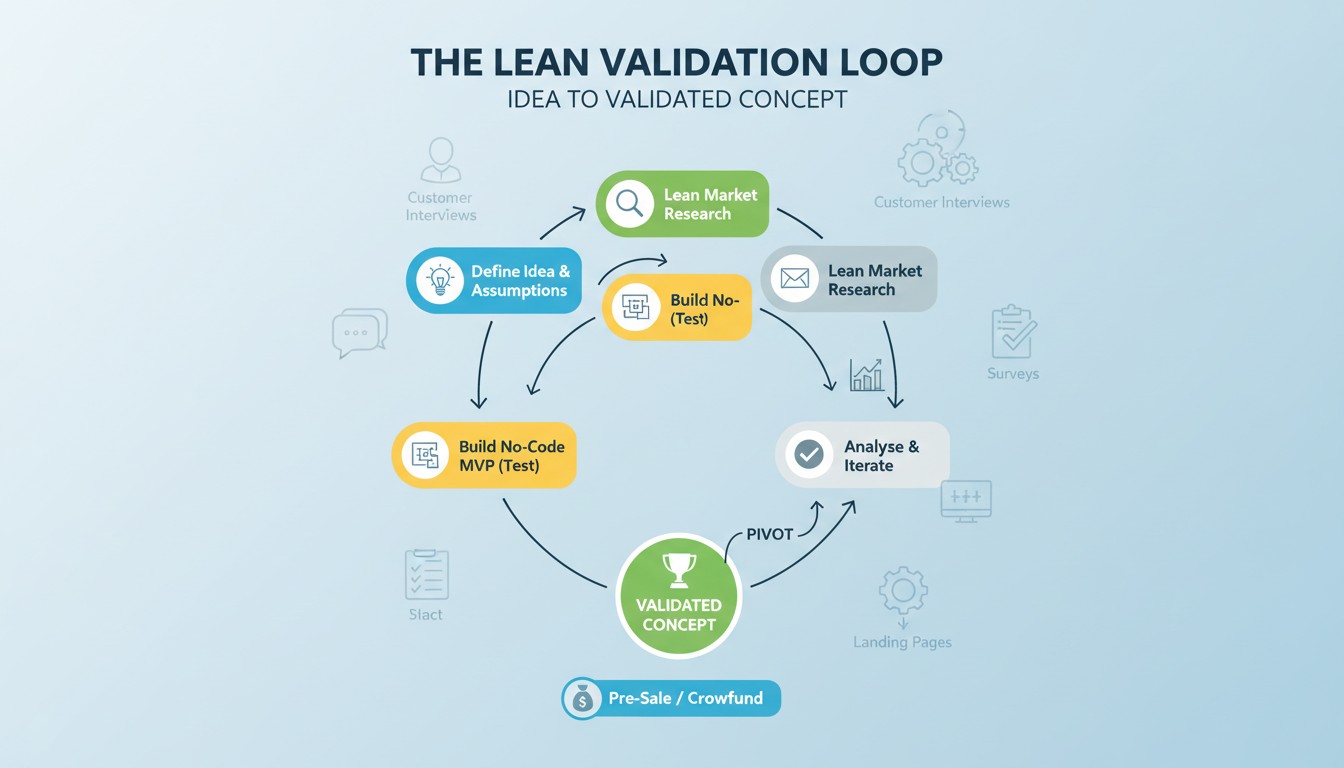

The 21-Day Market Immersion Sprint

Market understanding isn’t a one-time research project—it’s a 21-day sprint that rewires your brain to think like your customer. This isn’t about surveys; it’s about becoming a temporary anthropologist in their natural habitat. You must eat their diet, speak their language, and think their thoughts to truly understand what will make them reach for their wallet.

The sprint structure forces you to move from observation to conversation to validation, building a mental model that’s based on evidence, not imagination. Each phase has a specific question protocol designed to maximize insight while minimizing bias. The constraint of 21 days prevents analysis paralysis—you must act, document, and synthesize in real time.

The Market Immersion Calendar

Days 1-3 (Lurk): Join 5 communities. Don’t post. Bookmark every complaint. Use Reddit search: “[your market] + frustrated” or “[your market] + worst.” Spend 2 hours daily just reading. Notice which posts get 100+ upvotes—these are Tier 1 pains.

Days 4-7 (Document): Create a spreadsheet with columns: Quote, Theme, Frequency, Urgency. Log 100+ specific quotes. Group by theme. Identify the 3 problems that make people use ALL CAPS. Calculate how many times each appears. The math reveals truth.

Days 8-14 (Interview): Use Calendly to schedule 25 interviews. Cold LinkedIn message: “I’m a founder researching [specific problem]. 15 min, no pitch, just learning.” Aim for 20 interviews. Ask only past-behavior questions. Record with Zoom (free tier). Transcribe with Rev’s free trial. Look for patterns, not individual brilliance.

Days 15-17 (Synthesize): Create a one-page “Market Truth Document.” What did 15+ people say? What surprised you? What confirms your hypothesis? What kills it? This document becomes your product bible. Every feature decision must map back to it.

Days 18-21 (Test): Create a Typeform with your solution hypothesis. Share it in those communities you lurked in. If 100+ people complete it, you have a market. If 5 people complete it, you have a hobby. The sprint ends with data, not dreams.

The Segmentation Trap: Why “Everyone” Is the Wrong Answer

The most dangerous answer to “who’s your target market?” is “everyone who has [problem].” This reveals you haven’t done the work to find the “who most.” Not all problem-sufferers are created equal. Some will tolerate the problem forever. Some will pay $5/month to reduce it. Some will pay $500/month to eliminate it. Your job is to find the $500 segment first.

Segmentation requires asking “who is this so painful for that they’ve already tried to solve it?” The person who has cobbled together three free tools and two Zapier integrations is your customer. They’ve voted with their time that this problem matters. The person who says “yeah, that’s annoying” but hasn’t attempted any solution is a mirage—they’ll never convert.

The “Solution Attempt” Segmentation Method

Tier 1 (Highest Value): Has built a custom workaround. Has a spreadsheet. Uses 3+ tools to solve one problem. This person will pay premium for consolidation.

Tier 2 (High Value): Pays for a tool but complains constantly. Actively looking for alternatives. This person will switch for differentiation.

Tier 3 (Medium Value): Uses free tool. Satisfied enough. This person needs education about why problem matters before they’ll pay anything.

Tier 4 (No Value): Has never attempted a solution. Complains but doesn’t act. This person will waste your time with false signals. Ignore completely.

Your questions must filter for Tier 1 and 2. Ask: “What have you tried so far?” If they say “nothing, but I’m interested,” you’re talking to Tier 4. Smile, say thank you, and move on. If they say “I built this insane spreadsheet and I hate it,” you found gold.

The Empathy Gap: Why You Can’t Trust Your Own Instincts

Founders believe empathy means “I can imagine how they feel.” Real empathy means “I’ve listened to 50 people describe their day in such detail that I can predict what they’ll say before they say it.” The gap between these two is the difference between a product that resonates and one that sounds tone-deaf.

The empathy gap widens because you’re not your customer. You have founder privilege: you control your schedule, you’re comfortable with new tools, you’re risk-tolerant. Your customer has a boss, fears change, and is evaluated on consistency, not innovation. When you say “just import your data,” they hear “I might lose everything and get fired.”

Closing the empathy gap requires what anthropologists call “participant observation.” Don’t just ask questions—shadow them. Ask to watch their screen as they work. Have them share their desktop during the interview. You’ll see they have 47 browser tabs open, their desktop is a disaster, and they’re context-switching every 3 minutes. Your clean, minimalist interface becomes another cognitive burden, not a relief.

Building a Living Market Intelligence System

Market understanding isn’t a pre-launch activity—it’s a permanent function. The moment you stop talking to customers is the moment you start building for ghosts. The best founders schedule “customer service” days where they handle support tickets directly. They run monthly “voice of customer” reviews where they play interview recordings for the entire team. They maintain a “customer language doc” where interesting phrases are logged and later used in copy.

Create a system: Every Friday, interview one new customer. Every Monday, share one insight in Slack. Every month, update your “Market Truth Document” with new patterns. This rhythm ensures your product evolves with the market, not away from it.

Your system should include:

– A rolling interview schedule (aim for 5 per month minimum)

– A shared database of customer quotes (tagged by theme)

– A “Phrase Bank” for marketing copy

– A quarterly “Customer Advisory Board” video call

– An annual deep dive where you repeat the 21-day sprint to detect market shifts