The decision that determines whether your self-employment dream becomes a thriving business or a stressful hobby isn’t made when you quit your job—it’s made in the hundreds of micro-moments you spend learning, or avoiding learning, the skills that have nothing to do with your craft. While you perfect your technical expertise, you ignore the invisible architecture that transforms talent into income: financial literacy, digital marketing, sales negotiation, and systems thinking. Research from self-employment survival studies shows that 73% of freelancers who fail within three years cite “lack of business skills” as the primary cause, not lack of talent.

This skills gap creates a paradox: you’re an expert in delivering your service but a novice in building a business around it. You can design a stunning logo but can’t price it profitably. You can build a custom cabinet but can’t negotiate payment terms that protect your cash flow. You can write compelling copy but can’t generate enough leads to fill your pipeline. Understanding which skills to learn early—and which to deprioritize—transforms you from a skilled technician into a sustainable enterprise.

- The Invisible Architecture: How Missing Skills Quietly Kill Your Business

- The Skill Value Hierarchy: What Actually Determines Your Income

- The Psychology of Skill Blindness: Why We Master Craft and Ignore Business

- The Craft Identity Trap: You Are What You Do

- The Confirmation Bias Loop: You See What You Search For

- The Education Gap: No One Taught You to Be a Business

- Real-World Impact: The $100,000 Skill Gap

- The Photographer Who Learned Pricing Psychology and Tripled Revenue

- The Developer Who Ignored Sales and Lived Feast-or-Famine

- The Consultant Who Mastered Cash Flow and Bought a House

- The Compound Effect: Why Early Skill Acquisition Creates Exponential Returns

- The Tipping Point of Competency

- The Skill Investment Cascade

- Practical Playbook: Your 90-Day Skill Acquisition Sprint

- Weeks 1-2: The Skills Audit & Prioritization

- Weeks 3-6: The Immersion Phase

- Weeks 7-12: The Integration & Scale

- Your Craft Opens the Door—Your Business Skills Keep You in the Room

The Invisible Architecture: How Missing Skills Quietly Kill Your Business

Every aspect of self-employment success rests on a foundation of competencies that have nothing to do with your core craft. The speed of your quote-to-cash cycle, the consistency of your lead pipeline, the health of your cash reserves—these aren’t determined by how good you are at your craft, but by how good you are at the business of your craft. Operations experts call this “enterprise ability,” but it’s more accurately a survival filter that separates profitable businesses from expensive hobbies.

Consider something as mundane as reading a profit and loss statement. A self-employed consultant charges $150/hour, works 40 billable hours weekly, and assumes they’re making $312,000 annually. But they never learned to subtract the 30% effective tax rate, the $1,200/month health insurance, the 20% non-billable hours spent on admin, the software subscriptions, and the irregular cash flow that forces them to take predatory merchant advances at 35% APR. Their real hourly rate is $62, not $150. That math gap doesn’t just reduce income—it creates a psychological crisis when they realize they’re earning less than their former salary while working twice as hard.

Digital marketing creates similar invisible impacts. A brilliant photographer relies on word-of-mouth but never learns SEO. Their competitor, with mediocre skills but a basic understanding of “wedding photographer + [city]” keyword optimization, appears on page one of Google and books 3x more clients at higher prices. The skill gap isn’t in taking photos—it’s in being found by people who need photos. According to WeWork’s analysis, freelancers with basic SEO skills earn 2.7x more than those without, regardless of portfolio quality.

The Skill Value Hierarchy: What Actually Determines Your Income

Critical Skills: Financial literacy, pricing strategy, sales negotiation, lead generation, cash flow management

Secondary Skills: Project management, time blocking, client communication, contract law basics, tax optimization

Tertiary Skills: Digital tools, social media, email marketing, CRM systems, invoicing software

Craft Skills: Your core technical expertise (design, coding, writing, building)

The Psychology of Skill Blindness: Why We Master Craft and Ignore Business

If business skills are so critical, why do the vast majority of self-employed people wait years to learn them—if they ever do? The answer lies in a combination of identity fusion, confirmation bias, and educational gaps that train our attention toward the comfortable expertise we’ve already mastered.

The Craft Identity Trap: You Are What You Do

When you introduce yourself as a “photographer,” “developer,” or “writer,” you’ve fused your identity with your craft. Learning that craft feels authentic. Learning sales feels like “becoming a salesperson,” which conflicts with your self-concept. This identity fusion makes business skills feel like a betrayal of your true calling.

The trap deepens because you enjoy practicing your craft. After a day of client work, you want to edit photos or write code, not read about cash flow management. But that enjoyment is precisely the problem—it blinds you to the fact that your craft is only 30% of what makes you successful. The other 70% is business, and ignoring it creates a silent failure spiral that feels like “bad luck” when it’s actually “bad planning.”

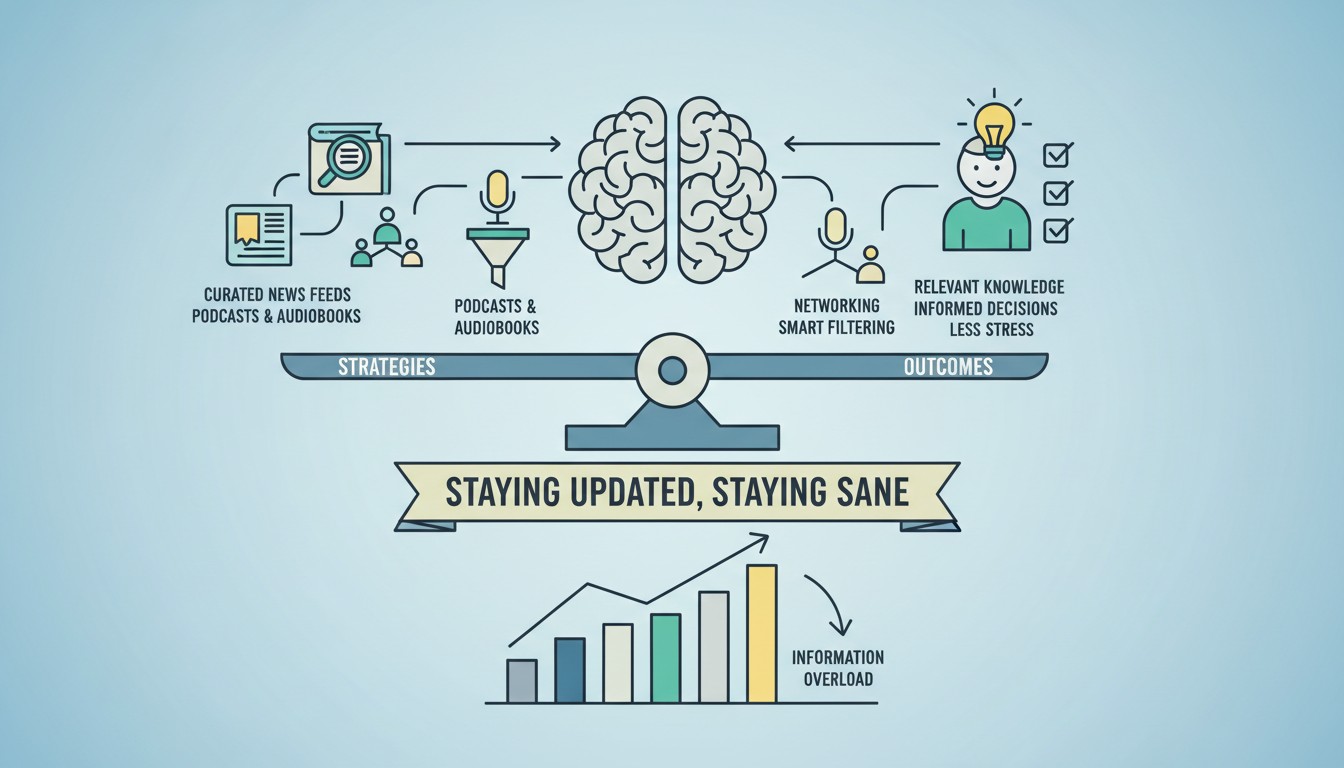

The Confirmation Bias Loop: You See What You Search For

When you believe “my craft is what matters,” you seek evidence that confirms this belief. You admire successful peers with exceptional portfolios, ignoring that they also have sophisticated marketing funnels. You read craft-focused blogs and follow other technicians on social media. You never encounter the business skills that would change your trajectory because your information diet is curated to avoid them.

This bias is reinforced by industry gatekeeping. Photography forums discuss camera gear, not pricing psychology. Developer communities debate frameworks, not lead generation. The craft world treats business as a “necessary evil” rather than the core competency it is. As a result, you can spend 10,000 hours mastering your craft and remain fundamentally unskilled at being self-employed.

The Education Gap: No One Taught You to Be a Business

Schools teach craft—design programs, writing workshops, coding bootcamps. They don’t teach “How to Price Your Services,” “How to Negotiate Payment Terms,” or “How to Build a Sales Pipeline.” This curriculum gap isn’t accidental; it’s easier to teach technical skills than to teach the uncomfortable truth that success is 70% business development and 30% delivery.

The consequence is generations of brilliant technicians who can execute flawlessly but can’t keep their pipeline full. They know every keyboard shortcut in Photoshop but freeze when a client asks for a discount. They can write elegant code but can’t write a proposal that justifies their rate. This knowledge gap creates a participation vacuum that business-savvy competitors fill effortlessly.

Real-World Impact: The $100,000 Skill Gap

These case studies demonstrate how self-employed individuals who acquired business skills early—or regretted not doing so—saw dramatically different financial outcomes.

The Photographer Who Learned Pricing Psychology and Tripled Revenue

A wedding photographer charged $2,500 per wedding based on “what felt fair” and struggled to book 15 weddings annually. After learning about value-based pricing and anchoring, they restructured their packages: $4,500 (premium), $3,200 (standard), and $2,000 (basic). The $2,000 package served as an anchor making $3,200 feel reasonable. They also learned about payment terms, requiring 50% deposit and final payment 30 days before the wedding, eliminating cash flow gaps. Within one season, they booked 22 weddings at an average $3,400 price point. Annual revenue jumped from $37,500 to $74,800 with the same marketing effort. The skill they wish they’d learned earlier? “That pricing is psychology, not math,” they said. “I left $100,000 on the table my first three years.”

The Developer Who Ignored Sales and Lived Feast-or-Famine

A full-stack developer spent five years mastering React, Node, and cloud architecture. Their portfolio was exceptional, but they averaged only 4-5 clients annually because they “hated sales” and relied entirely on Upwork. When Upwork increased fees from 5% to 20%, their effective hourly rate dropped from $95 to $76. They refused to learn cold outreach or LinkedIn marketing, considering it “spammy.” Meanwhile, a peer with average technical skills but a systematic outreach process (10 personalized messages daily) built a waitlist of 30 clients and charges $180/hour. The skilled developer hit $68K annual revenue; the marketing-savvy developer hit $185K. The regret? “I thought being good at code would be enough. I wish I’d spent half my learning time on business development instead of another JavaScript framework.”

The Consultant Who Mastered Cash Flow and Bought a House

A management consultant earned $150K their first year but had zero savings because they didn’t understand cash flow. They’d invoice clients, then spend the “windfall” without setting aside for quarterly taxes. In April, they faced a $32,000 tax bill with $4,200 in the bank. They took a 28% APR loan to cover it, costing $8,700 in interest. The next year, they learned the “profit first” system: immediately allocating 30% of every payment to a tax account, 20% to profit, and 50% to operating expenses. They also learned to negotiate payment terms—50% upfront, 50% on completion instead of net-30. By year three, they had $45,000 in reserves, bought a house, and slept soundly during a two-month client dry spell. “Learning cash flow management felt boring,” they admitted. “But it made me wealthier than any consulting methodology I mastered.”

The Compound Effect: Why Early Skill Acquisition Creates Exponential Returns

Business skills operate like compound interest—small, early investments generate exponentially larger returns over time. A self-employed professional who learns pricing psychology in Year One doesn’t just earn more that year; they build a foundation that affects every subsequent year’s income.

Consider learning sales fundamentals. In Year One, you close 30% of leads instead of 15%, adding $20K revenue. That extra revenue funds better tools and marketing in Year Two, increasing lead flow by 40%. Better tools and more revenue allow you to raise rates by 25% in Year Three. By Year Five, you’re earning $180K annually while a peer with identical craft skills but no sales training is stuck at $65K. The skill gap in Year One created a $115K differential by Year Five—not from working harder, but from learning earlier what actually drives income.

The reverse cascade is more common. Ignoring cash flow management for three years creates tax debt, credit card balances, and constant firefighting. The stress reduces your creative capacity, making your craft work less compelling. Clients sense your desperation and negotiate harder. You discount to get quick cash, training the market to expect low prices. By Year Five, you’re burned out, in debt, and convinced “self-employment doesn’t work” when it was simply skill underinvestment.

The Tipping Point of Competency

Business skills often work silently for months before their impact becomes visible. You study pricing psychology and nothing changes—until you quote your first new project using anchor pricing and win it at 40% higher than your old rate. You learn about SEO and nothing happens—for 90 days. Then one blog post ranks, driving 3 qualified leads weekly for two years. The skill investment compounds quietly until it reaches a critical mass that permanently alters your trajectory.

The Skill Investment Cascade

Initial Learning: Spend 40 hours learning sales fundamentals via podcasts/books

Direct Result: Close rate improves from 15% to 30%, +$20K Year One revenue

Secondary Effect: Extra revenue funds marketing, increasing lead flow 40% Year Two

Tertiary Effect: Stronger pipeline enables 25% rate increase Year Three

Quaternary Effect: $115K income differential vs. peer by Year Five, identical craft skills

Practical Playbook: Your 90-Day Skill Acquisition Sprint

Understanding which skills to learn is useless without a systematic approach to acquiring them. Here’s a concrete plan to move from craft expert to business owner.

Weeks 1-2: The Skills Audit & Prioritization

1. **Track your time for 5 days:** How many hours are spent on craft vs. business activities? Most self-employed spend <30% on business—flip this to 50/50

2. **Identify your #1 bottleneck:** Is it leads, pricing, cash flow, or time management? That’s your first skill to acquire

3. **Assess your financial literacy:** Can you read a P&L, calculate your real hourly rate, and project cash flow 90 days out? If not, start here

4. **Calculate your “hourly value”:** Annual revenue ÷ working hours. Any hour you spend on a task worth less than 50% of that rate is misallocated

5. **Commit to 5 hours weekly:** Block calendar time for deliberate skill acquisition, not just “learning as you go”

Weeks 3-6: The Immersion Phase

1. **Choose your learning stack:** For financial literacy, read “Profit First” and “The Personal MBA.” For sales, listen to “The Advanced Selling Podcast” and read “Win Without Pitching.” For marketing, study “SEO 2024” and “Building a StoryBrand”

2. **Find a peer group:** Join a mastermind or online community of self-employed people in different industries. Cross-pollination accelerates learning

3. **Implement one concept immediately:** Don’t wait to “master” sales—apply the first principle (e.g., always anchor high) to your next proposal

4. **Track your metrics:** Before/after close rate, average project value, days to payment, real hourly rate

5. **Hire a coach for one session:** A 90-minute call with a business coach ($200-400) can identify your blind spots faster than 20 hours of self-study

Weeks 7-12: The Integration & Scale

1. **Build your business systems:** Document your sales process, pricing calculator, and cash flow projections. Systems beat hustle

2. **Test your new skills:** Raise your rate 20% on new prospects. Implement upfront payments. Try one new lead generation channel

3. **Measure ROI:** Did your rate increase stick? Did upfront payments improve cash flow? Did new leads convert?

4. **Double down on what works:** If LinkedIn outreach generated leads, systematize it. If anchoring pricing increased project size, make it standard

5. **Plan your next skill:** The 90-day sprint becomes a recurring habit. Each quarter, identify and master one new business competency

Your Craft Opens the Door—Your Business Skills Keep You in the Room

The skills you’re ignoring aren’t boring administrative tasks—they’re the engine that transforms your talent into sustainable income. Every self-employed professional who out-earns you with inferior craft skills isn’t luckier or more connected. They’re simply fluent in the languages you refuse to learn: pricing psychology, cash flow management, sales negotiation, and lead generation.

Your power to build a six-figure self-employment practice doesn’t require better equipment, more certifications, or a viral portfolio. It requires one decision: to treat business skills with the same seriousness you treat your craft. The market rewards value delivery, not effort expenditure. The customer pays for outcomes, not hours. You can be the technician who struggles at $45/hour, or the business owner who thrives at $180/hour—with the same core talent.

Start today. Pick one skill. Spend five hours this week learning it. Your transformation begins with a single decision to stop being a skilled hobbyist and start being a professional business owner.